Rates Models & Yield

1. The Interest Mechanism

$M token operates within a balanced interest system in the M0 Protocol:

- Minter Interest Accrual: Minters accrue obligations at the minter rate on their outstanding $M balances.

- Earner Interest Accrual: Simultaneously, approved earning accounts accrue additional tokens at the earner rate.

- Rate Synchronization: The EarnerRateModel ensures the earner rate is calibrated so total earnings never exceed total minter obligations (see Rate Model section below for further details).

- Continuous Mechanism: Both sides update through independent but synchronized continuous indexing systems.

This creates a mathematically balanced system where earner yields are safely constrained by the protocol's income from minters.

$M token implements sophisticated interest rate models that ensure financial soundness while distributing yield between minters, earners, and the protocol.

2. Rate Model Architecture

The protocol uses two primary rate models:

- MinterRateModel: Determines the interest rate minters pay on borrowed $M token

- Simple model that reads rates directly from the TTG Registrar

- Capped at 400% APR (40,000 basis points) for system safety

- Governance-controlled through the

base_minter_rateparameter

- EarnerRateModel: Calculates the interest rate paid to $M token holders who opt in to earning

- Uses a mathematical formula that ensures financial soundness

- Rates are capped at 98% of the calculated safe rate

- Governed through the

max_earner_rateparameter

Minter Rate Calculation

The MinterRateModel has a straightforward implementation:

function rate() external view returns (uint256) {

return min(TTGRegistrar.get("base_minter_rate"), MAX_MINTER_RATE);

}- The rate is governance-controlled through the TTG Registrar

- Has a hard cap of 400% APR to prevent system abuse

- Changes to this rate affect all minters uniformly

Earner Rate Calculation

The EarnerRateModel employs a more complex approach to ensure system solvency:

function rate() external view returns (uint256) {

return min(

maxRate(),

getExtraSafeEarnerRate(

totalActiveOwedM,

totalEarningSupply,

minterRate

)

);

}Where:

getExtraSafeEarnerRateapplies the rate multiplier to the safe earner rateRATE_MULTIPLIERis 9,800 (98% in basis points)ONEis 10,000 (100% in basis points)maxRate()returns the governance-set maximum earner rate

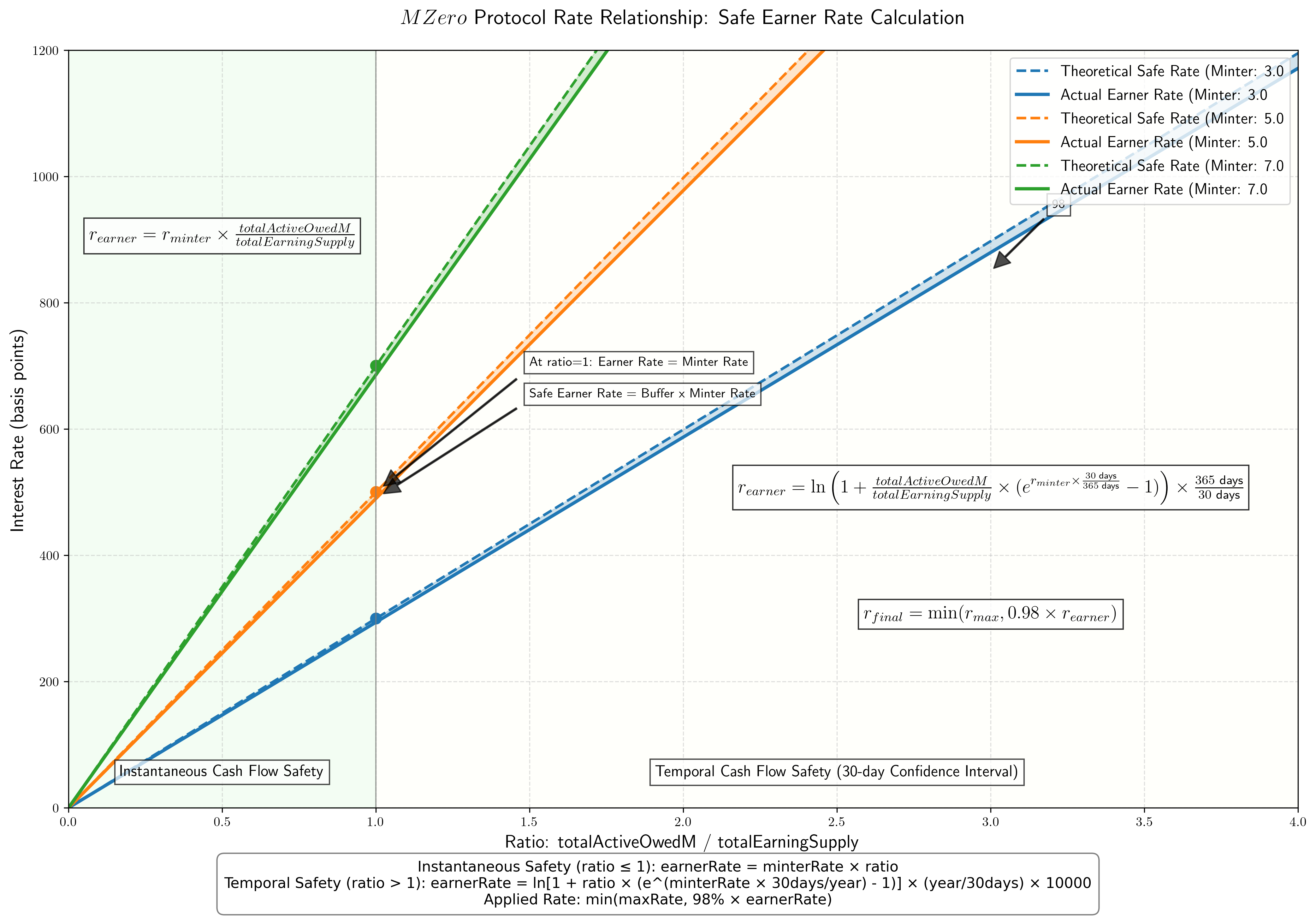

Safe Rate Derivation

The safe earner rate is calculated using two different approaches based on the relationship between total active owed $M and total earning supply:

- When totalActiveOwedM ≤ totalEarningSupply:

- Uses an instantaneous cashflow approach

safeRate = totalActiveOwedM × minterRate / totalEarningSupply- Ensures interest paid to earners never exceeds interest collected from minters

- When totalActiveOwedM > totalEarningSupply:

- Uses a time-integrated approach over a 30-day confidence interval

- Accounts for compound interest effects

- Applies complex mathematical formula to ensure long-term solvency

- Allows earner rate to temporarily exceed minter rate while maintaining system safety

Extra Safety Factor

The EarnerRateModel applies an additional safety factor to the calculated safe rate:

function getExtraSafeEarnerRate(

uint240 totalActiveOwedM_,

uint240 totalEarningSupply_,

uint32 minterRate_

) public pure returns (uint32) {

uint256 safeEarnerRate_ = getSafeEarnerRate(totalActiveOwedM_, totalEarningSupply_, minterRate_);

uint256 extraSafeEarnerRate_ = (safeEarnerRate_ * RATE_MULTIPLIER) / ONE;

return (extraSafeEarnerRate_ > type(uint32).max) ? type(uint32).max : uint32(extraSafeEarnerRate_);

}This ensures that earners receive 98% of the theoretically safe rate, creating an additional buffer for protocol safety.

Confidence Interval Approach

The EarnerRateModel uses a 30-day confidence interval to determine safe rates:

- Calculates the amount of interest minters will generate over 30 days

- Derives maximum earner rate that ensures total interest paid doesn't exceed this amount

- Accounts for the compounding effects of continuous interest

- Assumes the

updateIndex()function will be called at least once every 30 days

Balance Between Minters and Earners

The system maintains a mathematical relationship between interest flows:

totalInterestFromMinters = totalActiveOwedM × (e^(minterRate×Δt) - 1)

totalInterestToEarners = totalEarningSupply × (e^(earnerRate×Δt) - 1)The rate models ensure: totalInterestToEarners ≤ 98% of totalInterestFromMinters

Edge Cases Handling

The EarnerRateModel handles several edge cases with special logic:

- When

totalActiveOwedM = 0orminterRate = 0: The earner rate is set to 0 - When

totalEarningSupply = 0: The earner rate is set to the maximum possible value (type(uint32).max) - When calculations might overflow: The implementation includes safeguards against numerical issues

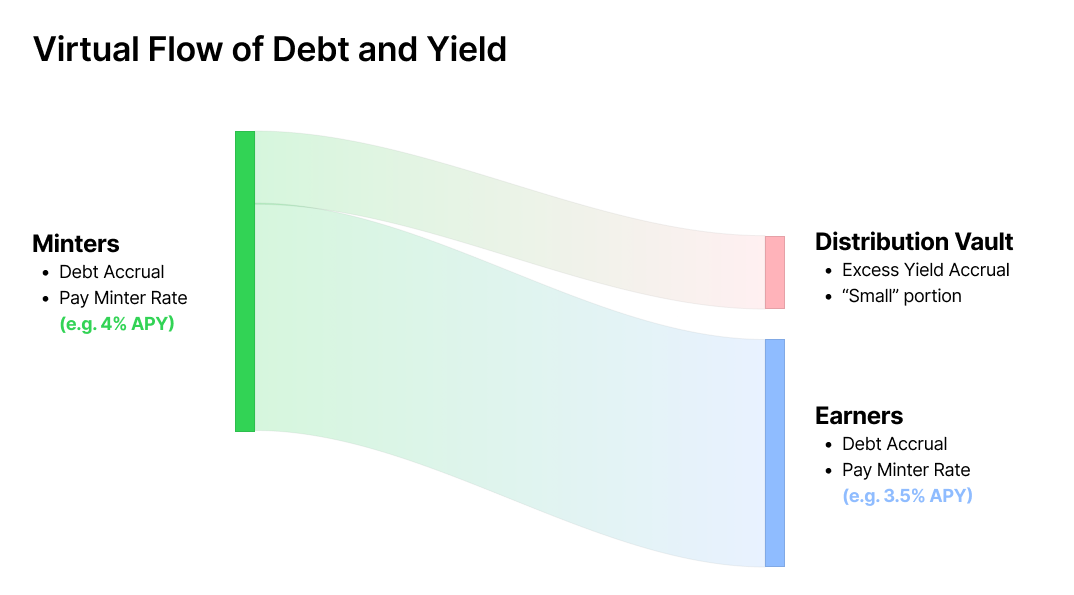

Yield Distribution

The system distributes yield in the following manner:

- Minters pay interest based on their outstanding debt at the minter rate

- Earners receive up to 98% of the available interest (subject to constraints)

- Excess yield (at least 2% plus any additional buffer) goes to the TTG Vault

- The TTG Vault funds protocol operations and can distribute to governance token holders

Rate Update Mechanism

Interest rates don't change automatically when governance parameters are updated:

- Rate changes in the TTG Registrar take effect only when

updateIndex()is called - Both $M token and MinterGateway must update their respective indices

- Updates occur automatically during key operations such as minting, burning, and transfers

- Rate models recalculate rates during each update based on current system state

Mathematical Precision

The implementation includes several technical considerations:

- Rates are stored in basis points (1/100 of a percent) for precision

- Calculations use fixed-point math with 12 decimal places (1e12 scaling)

- Exponential calculations use Padé approximants for gas-efficient computation

- Conservative rounding strategies favor protocol safety

Visuals